Did Rachel Reeves set Labour on a path

to ending austerity, and making up for the lack of public investment

over the last fourteen years? In this post I will follow the format

of my pre-budget

post, splitting the discussion into three sections:

public investment, current public spending and taxes. I’ve also

added an extra, rather annoyed section on fiscal rules, and a

summary.

Public investment

The chart below compares the net public

investment plans Reeves inherited from the last government, with her

Budget plans she gave to the OBR.

Under the

Conservatives public investment as a share of GDP was projected to

fall steadily from current levels of around 2.5% to 1.7%. The

assumptions that Reeves has given the OBR imply, to the first

approximation, public investment staying flat at 2.5% of GDP. That is

an improvement, but a relatively modest one, given the lack of public

investment over the last fourteen years.

Current public

spending

Current spending is

everything that isn’t gross public investment. The chart below

compares pre and post-Budget assumptions given to the OBR.

Here we have a

similar story. The Conservatives had pencilled in further cuts to the

public sector compared to current (23/4) levels, while Reeves has

assumed the share of public spending in GDP will be, to the first

approximation, pretty flat through the next five years at around the

current level of 40%. So no additional austerity compared to where we

are now, but no attempt to return spending to the levels needed to

restore the public services to the state they were in just before

austerity began in 2010. In particular, with health services around

the world absorbing an ever growing share of GDP, flat in overall

terms means most departments will see a falling share of spending in

GDP.

If that seems a

little disappointing, it is worth remembering two points. The first

is the extent of additional austerity implied by the inheritance

Reeves received, all to enable unsustainable tax cuts. Avoiding that

required the budget undertake substantial tax rises and considerable

additional borrowing. As the OBR sets out in the chart below, most

but not all of the additional current spending is matched by higher

taxes, with some covered by additional borrowing thanks to revised

fiscal rules.

The second point to

remember is that this is just one budget. My overall impression is

that, compared to the potential tax changes I went through in last

week’s post, Reeves has in most cases been relatively modest in the

increases implemented this time. That leaves scope for further

increases in spending matched by higher taxes, if necessary, in later

budgets.

Taxation

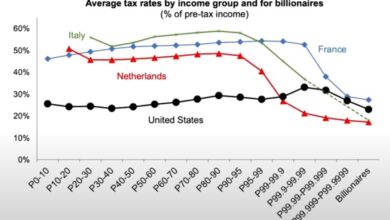

In my last post I

looked at areas of taxation where I thought significant amounts of

money could be raised (or, if you prefer talking about resources,

where a significant amount of resources could be released to allow

for additional public spending), without violating the pre-election

pledges not to raise income tax, employees NIC, VAT or corporation

tax.

-

Employers National Insurance Contributions

Raising employers NICs can be thought of as partially undoing the

reckless (in terms of unsustainable) cuts to employees NICs made by

the last government. In fact employers contributions are slightly

more progressive than employees, because there is no upper earnings

limit on employers contributions. (As I noted in that earlier post,

removing the upper earnings limit on employee contributions would

raise a significant amount of money in a very progressive way, but

was presumably precluded by pre-election pledges.)

This change in employers’ NICs accounts for more than half of the

additional revenue raised in the budget (£26 billion out of £42

billion by the end of the decade).

-

Other tax increases

As expected, both Capital Gains Tax and the Inheritance Tax regime

have been changed to increase revenues, but the scale of the former

in particular is modest compared to some of the possible changes I

outlined last week. In that sense, this is not so much a ‘soaking

the rich’ budget, but a ‘mildly inconveniencing the rich’

budget. As I noted then, there is a strong case for gradualism with

taxes that few pay and where behavioural changes are potentially

important, so this may not be the last time these taxes are

increased.

3. Fuel duty

In last week’s post I noted some tax increases that the

Conservatives had pencilled in which Reeves could cancel, but doing

so would only make her job harder. Fuel duty was one of those, and

here Reeves has not only decided to not increase the duty yet again

(on a day after floods generated by climate change killed dozens in

Spain), but is

in danger of continuing the Conservative practice of

planning future Fuel Tax increases but never implementing them.

Depressing.

Fiscal rules

Yes, counting government financial assets as well as liabilities

makes more sense than just counting liabilities, and this change to

the fiscal debt rule allows more public investment which is good.

However counting financial assets but ignoring physical assets still

makes little economic sense, so the new debt rule run alongside the

golden rule still has no purpose other than to suppress public

investment.

More unexpected was the gradual move to a three year rolling target

for the fiscal rules rather than a five year rolling target. This is

simply a mistake. The rationale for a five year ahead target is that

forecasts over this time frame exclude cyclical effects. This is

clearly not the case for three year ahead forecasts. The Treasury

document says that moving to three years ahead will

‘enhance fiscal discipline’, but so would balancing the budget

each year! Designing good fiscal rules tries to combine fiscal

discipline with good fiscal policy, and good fiscal policy should be

counter cyclical not pro-cyclical. This change will do almost nothing

to improve fiscal discipline but will make good fiscal policy more

difficult. (On fiscal discipline, see also Fuel Duty above!)

The reality is, unfortunately, that the design of fiscal rules is

increasingly a political exercise where good analysis is regarded as

far less important than short term expediency, the thoughts of

Krugman’s ‘Very Serious People’ or political journalists

(mediamacro). This is a problem because, as I always say, bad fiscal

rules are worse than no rules at all.

Summary

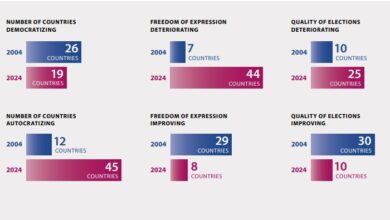

As most of the media will attack this budget for increasing taxes to

‘record highs’, without appearing to give a moment’s thought to

why taxes are rising

to record levels in most countries, it is natural to

be defensive of it. It is, after all, much better to travel in the

right direction, albeit slowly, than to keep on going the wrong way.

However, the political danger of moving gradually, in part because

one hand is tied behind your back (no tax rises on working people),

is that you disappoint those who are naturally impatient to see

improvements in public services across the board. A political

environment where voters know taxes are rising but where problems in

public service provision (including

child poverty) continue to fill the headlines is not a

comfortable one for any government, because it raises issues of

competence in voters’ minds (where is the money going?). Equally

risky is continuing to try and flatter the marginal voter (or petrol

user!) when you are in danger of losing your political base. I

suspect, once the immediate and rather predictable political

controversy is over, this budget will be seen as the minimum that

could have been done, and that something bolder might have been less

risky in the longer term.

Source link