Market

-

VAALCO Energy declares $0.0625 quarterly dividend

VAALCO Energy declares $0.0625 quarterly dividend Source link

Read More » -

Specialty Chemicals in Demand: Why Albemarle (ALB) Remains a Lithium Leader

Electric vehicle (EV) adoption is accelerating worldwide, and lithium remains the critical element powering this transformation. Global EV sales grew by 25% year-over-year to 17.1 million in 2024, with China leading the charge. Battery costs have also dropped by 20%, making EVs more affordable and reinforcing demand. The rapid rise in battery storage technology for renewable energy solutions further adds…

Read More » -

Eaton Vance Short Duration Diversified Income Fund raises monthly dividend by 0.1% to $0.0751/share

Eaton Vance Short Duration Diversified Income Fund raises monthly dividend by 0.1% to $0.0751/share Source link

Read More » -

Geopolitical Instability Boosts Rare Earths: Why MP Materials (MP) Could Be a Strategic Investment

Rare earth elements (REEs) are indispensable in modern technologies, from electric vehicles (EVs) to military defense systems and renewable energy. However, global supply chains remain highly concentrated, with China controlling nearly 70% of global REE mining and over 85% of processing capacity. Recent trade restrictions and U.S.-China tensions have heightened concerns over supply security. In July 2023, China imposed export…

Read More » -

Surging Cybersecurity Needs: Why CrowdStrike (CRWD) Could Lead the Next Wave

As digital threats intensify, enterprises worldwide are ramping up cybersecurity budgets. The global cybersecurity market is projected to register a CAGR of 12.9% to reach $500.7 billion by 2030, fueled by escalating cyberattacks and regulatory pressures. High-profile breaches, such as the MOVEit and Okta incidents in 2024, have underscored the vulnerabilities of corporate networks, pushing businesses to adopt more robust…

Read More » -

Rising Cyber Threats: Why SentinelOne (S) Could Be a Breakout Cybersecurity Stock

Cyber threats continue to grow in scale and sophistication, affecting businesses, governments, and individuals worldwide. In 2024, high-profile cyberattacks on multinational corporations and critical infrastructure highlighted vulnerabilities in existing security systems. According to recent reports, ransomware attacks alone have surged, with some estimates suggesting that global damages from cybercrime could surpass $12 trillion by 2025. With this escalating threat landscape,…

Read More » -

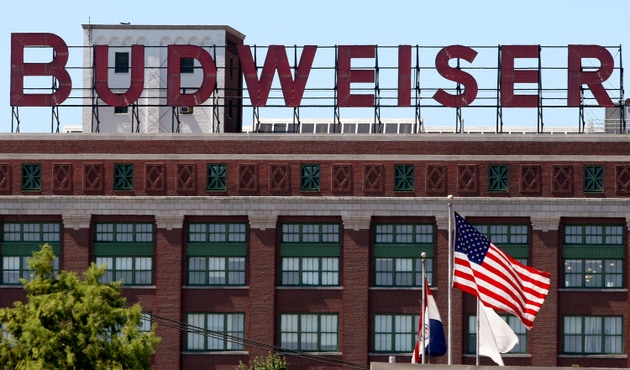

Budweiser maker Anheuser-Busch rebuys U.S. container plant stake for $3 billion (BUD:NYSE)

Whitney Curtis/Getty Images News Belgium-based brewer Anheuser-Busch InBev (BUD) has exercised its right to reacquire a 49.9% stake in its U.S. metal container plants from a consortium of institutional investors led and advised by Apollo Global Management (APO) in a deal Source link

Read More » -

OceanFirst to buy Flushing Financial, raises $225 million from Warburg Pincus (FFIC:NASDAQ)

To ensure this doesn’t happen in the future, please enable Javascript and cookies in your browser. Is this happening to you frequently? Please report it on our feedback forum. If you have an ad-blocker enabled you may be blocked from proceeding. Please disable your ad-blocker and refresh. Source link

Read More » -

AI in Healthcare: Why Tempus AI (TEM) Could Be a Game-Changer in Precision Medicine

Artificial intelligence is rapidly reshaping the healthcare industry, particularly in diagnostics and drug development. AI-powered platforms are accelerating the identification of disease patterns, optimizing treatment protocols, and reducing research timelines. The AI healthcare industry is expected to surpass $148 billion in market value by 2029. One company leading this transformation is Tempus AI, Inc. (TEM). Specializing in AI-driven precision medicine,…

Read More » -

Willis Towers Watson’s subsidiary prices $1B senior note offering

Willis Towers Watson (WTW) has announced the pricing of a registered offering totaling $1 billion in senior unsecured notes by its indirect wholly-owned subsidiary, Willis North America Inc. The notes are structured as follows: $700 million aggregate principal amount of 4.550% senior Source link

Read More »