The 2026 tax filing season is officially open, and for millions of Americans, the envelopes arriving in mailboxes (or the notifications pinging phones) are going to contain a pleasant surprise.

Thanks to the legislation passed last July—formally known as the One Big Beautiful Bill Act—refunds are projected to be significantly larger this year.

While getting a fat check from the Treasury feels like winning a mini lottery, I’m going to be the buzzkill friend who reminds you of the truth: A tax refund is not a gift. It is an interest-free loan you gave to the government for the last 12 months.

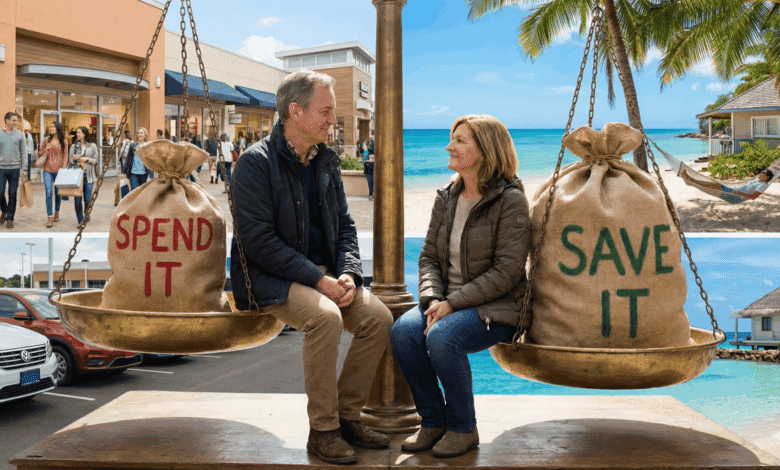

But since the money is coming back to you, the smartest play is to put it to work. Here is why your check is likely bigger this year — and five specific ways to use it to build actual wealth.

Why your refund is bigger this year

The Big Beautiful Bill introduced sweeping changes to the tax code mid-year, which means your paycheck withholding likely didn’t adjust fast enough to keep up. When you file your 2025 return this spring, you are catching up on those breaks.

First, the standard deduction saw a massive jump to $15,750 for singles and $31,500 for married couples.

Second, new deductions for working-class income took effect retroactive to Jan. 1, 2025. If you work in the service industry or pull long hours, the new “No Tax on Tips” and “No Tax on Overtime” provisions mean income you already paid taxes on via withholding is now effectively tax-free (up to certain limits), triggering a refund.

Add in the new deduction for car loan interest and the expanded Child Tax Credit of $2,200, and the math tilts heavily in your favor. The Tax Foundation estimates these changes reduced individual taxes by roughly $129 billion for 2025, much of which is coming back as refunds right now.

So, you have the cash. Now, what do you do with it?

1. Destroy your high-interest debt

This is the unsexy, non-negotiable first step. If you are carrying a balance on a credit card, you are likely paying upwards of 20% interest. There is no investment in the world that guarantees a 20% return, but paying off that debt does exactly that.

Using your refund to wipe out a $3,000 credit card balance isn’t just “spending” the money; it’s buying yourself freedom from monthly payments. If you ignore this and buy a new TV instead, you are essentially financing that TV at 20% interest. Don’t do it.

2. Fully fund your emergency brake

We often call this an emergency fund, but think of it as an emergency brake. When life spins out of control—a layoff, a blown transmission, a medical deductible—this cash stops you from crashing into debt.

Surveys consistently show that a terrifying percentage of Americans cannot cover a $1,000 emergency with cash savings. If your refund is substantial, deposit it directly into a high-yield savings account that is separate from your checking.

Aim for three to six months of living expenses. If that feels impossible, start with $1,000. It is the buffer that keeps a bad week from becoming a bad year.

3. Feed your Roth IRA

If your debt is gone and your savings are secure, look at your future. A Roth IRA is one of the best vehicles for this because you contribute with after-tax dollars—which is exactly what your refund is.

You can contribute up to $7,000 (or $8,000 if you are 50 or older) for the 2025 tax year up until the April filing deadline. The beauty of the Roth is that your money grows tax-free, and you can withdraw it tax-free in retirement. Using a refund to max this out is like taking money the government gave back to you and putting it where they can never touch it again.

4. Invest in home value, not just decor

If you own a home, it’s tempting to use a windfall for new furniture or a cosmetic refresh. Instead, look for unglamorous improvements that actually add value or save you money.

Consider energy-efficiency upgrades. Things like sealing drafts, adding attic insulation, or upgrading a thermostat pay you back every month in lower utility bills. If you use your refund to fix a leaky pipe or replace a dying water heater before it floods your basement, you are performing a “preventative investment” that saves thousands down the road.

Fix your W-4

Once you’ve decided what to do with your big refund, don’t forget to ensure you don’t get one next year.

I know, it feels good to get that check. But if you get a $3,000 refund, that means you lived on $250 less per month than you actually earned all year. That is $250 you could have used to pay down debt month-by-month, invest, or simply handle rising grocery costs.

Go to your HR department or use the IRS tax withholding estimator to adjust your W-4 form. The goal is to break even—to pay exactly what you owe and not a penny more. Keep your money in your pocket where it belongs, not in Uncle Sam’s interest-free vault.

There’s only one exception: If you just can’t seem to manage your money from month to month and depend on that annual cash infusion, fine. Go ahead.

But it would be nice if you didn’t give Uncle Sam an interest-free loan every year. After all, he’s not doing that for you.

Source link