What

a future Labour government will be able to do in terms of repairing

both our broken public services, our broken economy, and getting

cheaper green energy will depend in part on its decisions about

fiscal rules. [1] When hopes and expectations are frustrated as a result

of these rules, you will hear a lot about how such rules are

neoliberal and should be scrapped. So are fiscal rules neoliberal, by

which I mean are they just instruments designed to suppress public

spending and cut taxes?

The

answer to my question is of course yes and no. First the no. Fiscal

rules arose out of a problem that can occur under any government,

including neoliberal ones. Politicians, particularly before an

election, will be tempted to increase spending or cut taxes and pay

for it by borrowing or creating money because for many voters that

seems costless: there appear to be only winners and no losers. This

problem used to be called deficit bias.

We

can see this happening right now in the UK, with the Chancellor

wanting to cut taxes in an effort to boost the government’s

popularity, and his own fiscal rules reportedly

constraining him in the amount he can do. When Trump was President he

and a Republican Congress cut taxes, mainly on the wealthy, by

increasing the deficit rather than cutting spending or raising other

taxes. He was able to do so because the US government does not follow

the golden rule, which aims to roughly match day to day spending

against tax revenue. [2]

Why

does it matter that politicians can fool voters in this way?

Increasing spending or cutting taxes when the economy is not in a

recessionary period [3] will increase aggregate demand, putting

upward pressure on inflation. The central bank will raise interest

rates to stop inflation increasing. Eventually a government is likely

to have to reverse the giveaway by raising taxes or cutting spending [4]. On both counts

there will be a cost to many people of unsustainable fiscal

giveaways. As long as those costs are not acknowledged by politicians

or the media, democracy suffers.

Other

reasons often given for the need to have fiscal rules are less

convincing in my view. It is often suggested that we need rules to

appease the financial markets. I see no evidence for this for any

advanced major economy. Did the bond markets refuse to buy US

government debt when Trump cut taxes? Have the bond markets raised

rates every time this Conservative government changed its fiscal

rules because the old ones would be broken? The Truss episode was

about

interest rate uncertainty

created by cutting taxes in a situation where spending plans were not

specified and might not have been credible if they had been, not

about breaking fiscal rules.

Another

unconvincing reason for having fiscal rules is that a higher level of

government debt will harm the economy. Again, for advanced major

economies there is no evidence of this. Will a higher level of

government debt impose a burden on future generations? It may or may

not, depending on the future relationship between interest rates and

economic growth, and the evidence from the past is that on average it

has not. It is particularly hypocritical to use this ‘burden’

claim to stop governments borrowing for spending that will benefit

future generations.

Making

our democracy function better by making governments more fiscally

responsible is nice to have but hardly of critical importance. It is

why I have often said that bad fiscal rules are worse than having no

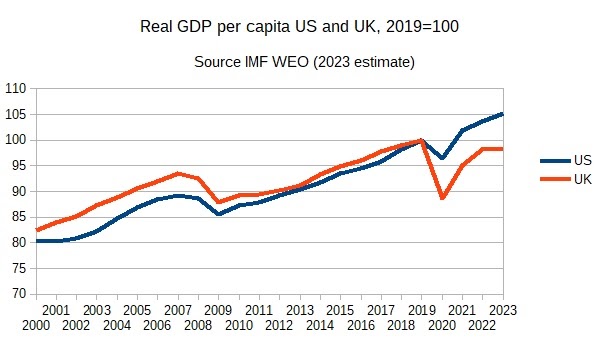

rules at all. If you want a vivid illustration of this, compare the

recovery from the pandemic in the UK and US.

Eurozone

performance has only been slightly better than the UK. What do the UK

and the Eurozone have in common? Adherence to fiscal rules that have

constrained the recovery from the pandemic. If similar rules had been

applied in the US, we would probably not have seen the post-pandemic

Biden stimulus

and the Inflation

Reduction Act,

both of which have been important in making the US an outstanding

success in terms of economic recovery from the pandemic (as well as

reducing inequality, tackling climate change and a lot else as well).

One

class of bad fiscal rules are rules used to promote an ideological

goal, like shrinking the state. A clear example of a fiscal rule that

could be justly labelled neoliberal is one that limits government

spending but not taxes. Unfortunately a section of the governing

elite in Brussels has tended to see fiscal rules as a way of

constraining expenditure. When France initially raised taxes in the

early 2010s to reduce the deficit, then Commissioner

Olli Rehn said

“Budgetary discipline must come from a reduction in public spending

and not from new taxes.” But even rules that appear balanced may in

practice not be, which brings me to the UK’s debt to GDP rule.

Although

the fiscal rule that debt to GDP has to be falling by the end of five

years may (and I emphasise may for reasons set

out here)

be constraining this government’s ability to cut taxes, what it has

already done is reduced their plans for public investment, which is now set to fall steadily as a share of GDP over the next five years. Indeed,

when the falling debt to GDP rule is combined with the golden rule

then most of the time all the falling debt to GDP rule adds to the

golden rule is to place a limit on public investment. For that

reason, the falling debt to GDP fiscal rule could reasonably be

called the ‘reduce public investment’ rule.

Governments should always have robust means of deciding whether individual public investment projects are good value for money, and the more open these are the better. As long as this test is passed, what benefit can there be in constraining public investment at the aggregate level? Another

way to see why any fiscal rule that constrains aggregate public investment is a bad rule is to go back to reasons given for

having fiscal rules in the first place.

I

argued that fiscal rules are useful in stopping governments bribing

the electorate by cutting taxes or increasing spending and concealing

the costs by borrowing. But if public investment projects are

individually worth doing, it should be paid for by borrowing just as

an individual pays for a house by taking out a mortgage, or a firm

undertakes an investment by borrowing. Even the unconvincing reasons

for having fiscal rules don’t apply to public investment: future

generations benefit, debt is matched by useful assets that benefit

the economy and so on.

If

bad fiscal rules like the falling debt to GDP rule are worse than no

fiscal rules, why isn’t the second best of getting rid of all fiscal rules a

less risky way forward? Second best is reasonable when it is much

easier to achieve than the first best. But with fiscal rules the opposite

is true. There is no way a Labour government is going to abandon all

fiscal rules, whereas there is at least some prospect of it getting

rid of bad rules and keeping the better rules. In this particular

case, first best is more achievable than the second best.

In

opposition Rachel Reeves has already adopted the falling debt to GDP

rule, just as John McDonnell did. This rule and this alone is the

reason Labour are in such a mess over its sensible £28

billion pledge

to green the economy. In a rational world it would be obvious to

ditch the bad fiscal rule to enable desperately needed green

investment. In the run up to an election, with the media we have, we

are very far from a rational world.

But

once in government, what Labour says and does has to change, even if

their only goal is to be re-elected. With time and new leaders

memories of just how bad this Conservative government has been will

fade, and are in danger of being replaced with the disappointed

expectations of those that voted Labour expecting major change. Being

only slightly less bad than this current government will not see a

new Labour government last as long as the last one. For that very

narrow reason alone, one of a Labour government’s first acts needs

to be to discard the falling debt to GDP rule, or change it in such a

way as to prevent it constraining investment. Labour’s success in

revitalising our moribund economy will depend perhaps more than

anything on getting rid of this anti-investment fiscal rule.

[1] It will depend at least as much on their willingness to raise taxes.

[2]

I use ‘roughly match’ rather than ‘equal’ deliberately,

because there is no magic about trying to hit a zero current balance.

I also use ‘aiming to’ deliberately. For various reasons tax

revenue and spending fluctuate year to year and it would be bad

economics to try and suppress or counteract those short term fluctuations. Instead

policy should aim to hit a rolling target for the current balance in

five years time, using forecasts produced or verified by an

independent fiscal watchdog. For reasons discussed here, the OBR is

not sufficiently independent to play this role.

[3] Recessionary periods are times when there is either a significant

chance that output growth will be substantially below trend or

negative, output growth is substantially below trend or negative, or

the economy is recovering from output growth having recently been

substantially below trend or negative. During recessionary periods,

any fiscal rule should be suspended and fiscal policy should aim to

restore the economy to good health as quickly as possible.

[4]

Running deficits of a sufficient size to make the debt to GDP or reserves to GDP ratio

rise forever

is not sustainable. Eventually the government will choose to default

on its debt rather than raise taxes to pay ever higher debt interest,

or more probably inflate away the debt. For this reason advanced

economies do not permanently run these large deficits. It is

important to distinguish this situation, of unsustainable permanent deficits,

with a one-off but permanent increase in the level of debt to GDP

caused by temporary large deficit, which is sustainable.

Source link