Snapchat has published a new study into the variance in impact of branding and direct response campaigns, and which actually drives more direct sales activity in the app.

The study, based on insights from TransUnion and Dentsu, examines how the varying focus of campaigns changes their eventual results, based on over three years of data from 36 advertisers across different verticals.

The result?

“Although the share of spend between brand and DR was different per category, we found that across the board, there is no tradeoff, and both campaign strategies were efficient in driving sales. Both the brand and DR campaigns contribute disproportionately more sales relative to the share of budget each campaign type receives.”

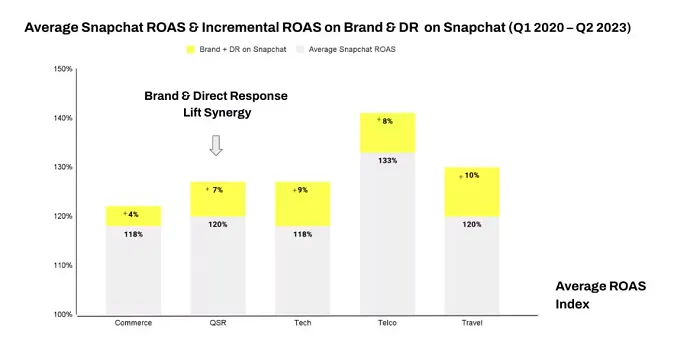

As you can see in this chart, the relative performance of Snap campaigns for both brand and direct response is closely aligned, with the amount spent being the key driver of sales performance.

As per Snap:

“One key takeaway from the research is that brand activity drives sales, especially on Snapchat. If we take a closer look at the Commerce category for example, when ROAS is split out between brand and DR campaigns, the research found that while both campaign types drive above average ROAS, brand spend drove the higher ROAS. Brand spend driving above average ROAS was not unique just for the Commerce vertical. This is true across all the other categories in our research.”

Snapchat also found that combining both branding and direct response campaigns drove even better response.

“Across all of the verticals, the analysis revealed that running brand and DR campaigns concurrently delivers incremental ROAS compared to running in isolation to one another.”

Essentially, while there’s a lot of ad industry jargon here, the study’s conclusion is that advertisers can drive greater campaign success on Snap by increasing their spend across both brand and direct response approaches, with the combination of the two helping to maximize reach and resonance, as well as direct sales.

Which, given this is a study published by Snap itself, is no real surprise, but the data backs up the idea that Snap advertisers do see more sales activity when pushing both approaches, as opposed to focusing on one or the other.

Some more food for thought for your Snap ads approach.

You can read Snapchat’s full study overview here.

Source link