When did things

start going wrong in the UK? Many

would give the Global Financial Crisis (GFC) as the

answer. Now that may be a good answer for some reasons (see below),

but I want to suggest one reason that is perhaps not so good as it

first appears. That reason is labour productivity, growth and living

standards.

Why does it appear

to be the answer for UK productivity and growth? Here I can just

refer to the chart that is at the

top of my post two weeks ago, showing UK GDP per head

before and after the GFC. As I have noted many times, underlying

growth in UK GDP per head (and therefore to a first approximation

real earnings) before the GFC is remarkably consistent, with a trend

growth rate since the 1950s of just over 2%. There are of course

booms and recessions around that trend, but until 2007 every economic

downturn seemed to be followed by a recovery that put the level of

GDP per head back on its trend line. Of course that constancy from

the 1950s until the 2000s could well be a coincidence, with different

factors influencing productivity more than others over particular

parts of those fifty odd years.

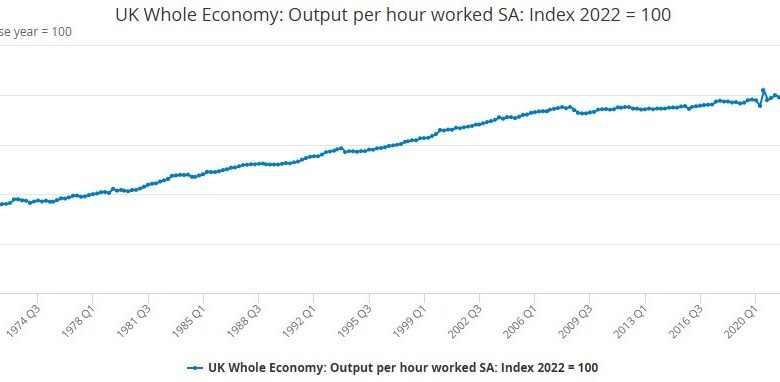

Below is UK output

per hour worked, which shows the same pattern (source)

After the recession

of 2008/9 there was almost no recovery in the sense of output or

productivity growing faster than trend. So the level of productivity

and GDP per head did not return to its previous trend line. In

addition, the growth rate also slowed substantially, to something

like half the previous trend. It therefore looks like something

disastrous happened around 2007, and the Global Financial Crisis is

the obvious culprit.

Now we all know that

the GFC started in the United States, and that the US financial

system was also very badly hit by that crisis. Below is a picture of

US productivity growth (output per hour in the non-farm economy).

It is a more complex

picture than for the UK, but growth after 2007 does not look that

different from growth since the 1970s, with the exception of a period

of more rapid expansion from the mid-1990s to the mid 2000s. That

period of more rapid growth is generally put down to the impact of

the IT revolution. Here are some average annual growth rates:

Year on year productivity growth in the

US (defn and source as previous chart)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If we put the rapid

growth around the millennium down to the IT revolution, then there is

no downward shift in either the level or the growth rate of

productivity as a result of the GFC.

Now it is of course

possible that the GFC had a much more profound impact on UK growth

than in the US. But there is an additional empirical reason to doubt

that the GFC was the obvious reason why UK productivity growth

declined so drastically. Below is a chart of productivity in the UK

financial sector [1].

Financial services

productivity started growing rapidly around 2004/5. We now know this

was unsustainable, because it was based on levels of leverage that

meant the sector could not survive significant negative shocks. If we

take financial services out of the UK aggregate, then it becomes

apparent that productivity growth in the rest of the economy began to

slow from the post-war trend a few years before 2007. In addition the

growth rate in the early 2010s is a bit better than the aggregate

figures suggest.

It was for this

reason that in this previous post I was careful to talk about a

productivity slowdown, in the UK and elsewhere, that happened around

2005, rather than after the GFC. Why does a difference of a few years

matter? As the reason for the decline in UK productivity relative to

other advanced economies remains something of a puzzle, associating

it with the GFC naturally focuses attention on financial factors to explain that puzzle. Placing the decline starting

around 2005 allows for a wider range of possibilities.

In particular, it

ties UK productivity trends more closely to those in the US. Perhaps

UK productivity growth also benefited from the IT revolution around

the millennium, and so at least part of the absolute decline in UK’s

productivity growth since around 2005 is a result of that revolution

petering out, just as we saw in the US. Doing this allows us to be far more eclectic about when

underlying UK productivity started growing less than other major

economies like the US. Excluding finance, UK productivity growth was

quite strong after the recession, and it is only around 2013 that

growth rates seem to clearly shift to below US levels. Of course none

of this rules the GFC out as a key factor in explaining the UK

productivity puzzle, but it does remove the GFC as the empirically

compelling cause.

Are there other

reasons besides growth for suggesting the GFC was the beginning of

the UK’s recent relative decline? The obvious answer is that the

deep recession it caused was key in ending the Labour government, and

therefore starting a period of Conservative government that has been

economically disastrous. However even this could be contested. Gordon

Brown became pretty unpopular as Prime Minister well before the

recession hit, and some would argue his standing as PM rose as a

result of his handling of the GFC.

It is also crucial

not to get the impact of the GFC crisis confused with the policy

response to it, which was general fiscal consolidation, aka

austerity. The long period of ultra low interest rates that began

during the GFC but lasted for the next decade, and which helped

create a boom in asset prices including house prices, was not a

result of the GFC but was instead due to fiscal austerity. If the

2010 Coalition government, and governments around the world, had

responded to the GFC recession by continuing rather than reversing

fiscal expansion, as financial markets were crying out for them to do

(because all interest rates were so low), then the

period of ultra low rates would have ended in the early 2010s,

and we would not have seen such a marked increase in asset prices.

[1] Levels

extrapolated from growth rates, source.

Source link